The recently enacted One Big Beautiful Bill Act (OBBBA) brings significant and favorable changes to the tax treatment of research and development (R&D) expenditures for U.S. businesses. These updates are designed to encourage innovation, support domestic investment, and simplify compliance for taxpayers engaged in R&D activities.

Below, we outline the key changes, their impact on your business, and practical steps to maximize your tax benefits under the new law.

1. Full Expensing of Domestic R&D Expenditures Restored

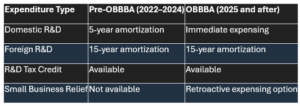

Prior to OBBBA, businesses were required to capitalize and amortize all R&D expenditures over five years (15 years for foreign research), a rule that took effect for tax years beginning after December 31, 2021. This change, introduced by the Tax Cuts and Jobs Act (TCJA), significantly reduced the immediate tax benefit of R&D investments.

OBBBA Update:

For tax years beginning after December 31, 2024, businesses can once again fully deduct domestic R&D expenditures in the year they are incurred. This allows immediate expensing of domestic research or experimental expenditures, including software development costs. Businesses may also elect to amortize these costs over a period of at least 60 months if preferred. However, foreign R&D expenditures must still be amortized over 15 years.

2. Coordination with the R&D Tax Credit

What Changed:

The R&D tax credit under IRC § 41 remains a valuable incentive, providing a credit for increasing research activities. The OBBBA aligns the definition of qualified research expenditures (QREs) for the credit with the new expensing rules under

§ 174A, ensuring that expenses eligible for immediate deduction are also eligible for the credit.

Key Points:

- Qualified research must be conducted in the U.S. to be eligible for both the deduction and the credit.

- The credit calculation and substantiation requirements remain unchanged, but the ability to expense R&D costs immediately may increase the pool of eligible expenses.

3. Transition Relief and Retroactive Application for Small Businesses

OBBBA provides a special election for eligible small businesses to apply the new expensing rules retroactively to tax years beginning after December 31, 2021. This allows qualifying businesses to amend prior returns and claim immediate deductions for domestic R&D costs that were previously capitalized and amortized.

Eligibility:

A small business is generally defined as one that meets the gross receipts test (less than 31 million in revenue)

4. Practical Guidance for Businesses

A. Review and Update R&D Accounting Policies

- Ensure your accounting systems are set up to identify and track domestic versus foreign R&D expenditures.

- For 2025 and beyond, domestic R&D costs can be fully expensed; foreign R&D must still be amortized over 15 years.

B. Maximize the R&D Tax Credit

- Coordinate your deduction and credit claims to ensure all eligible expenses are captured.

- Maintain robust documentation to substantiate both the deduction and the credit, including project descriptions, employee time allocations, and supporting financial records.

C. Consider Retroactive Claims

- If you are a small business, evaluate whether you qualify for the retroactive application of the new expensing rules.

- Consult your Rudler, PSC advisor about amending prior returns to claim additional deductions and potential refunds.

D. Plan for Future R&D Investments

- With immediate expensing restored, consider accelerating or expanding domestic R&D projects to take full advantage of the enhanced tax benefits.

Summary Table: R&D Tax Treatment Under OBBBA

Conclusion

The OBBBA’s restoration of immediate expensing for domestic R&D expenditures, along with continued availability of the R&D tax credit, represents a significant opportunity for U.S. businesses to reduce their tax burden and reinvest in innovation. We recommend reviewing your current and planned R&D activities with your Rudler, PSC advisor to ensure you are fully leveraging these enhanced incentives.

If you have questions about how these changes affect your business or need assistance with R&D tax credit claims, please contact our office. We are here to help you navigate the new rules and maximize your tax benefits.

Important: These are all new changes, and further guidance from the IRS and Treasury Department is expected. The details may change as new regulations and clarifications are issued. Be sure to consult with your tax advisor to understand how these changes affect your specific situation.

RUDLER, PSC CPAs and Business Advisors

This week's Rudler Review is presented by Max Epplen, CPA.

If you would like to discuss your particular situation, contact Max at 859-331-1717.

As part of Rudler, PSC's commitment to true proactive client partnerships, we have encouraged our professionals to specialize in their areas of interest, providing clients with specialized knowledge and strategic relationships. Be sure to receive future Rudler Reviews for advice from our experts, sign up today !