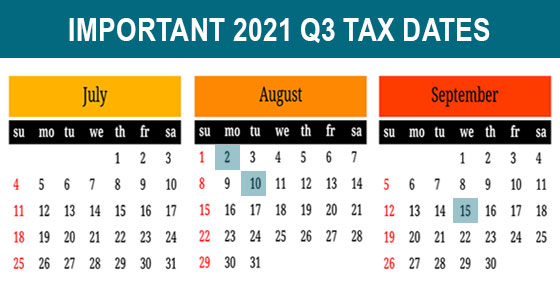

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021.

Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you.

Read below about the major tax deadlines coming up this quarter that may affect your business. Please note that this is not a full list of all tax deadlines occurring in the 3rd quarter. Contact your Rudler, PSC advisor at 859-331-1717 to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Monday, August 2

Employers report income tax withholding and FICA taxes for second quarter 2021 (Form 941) and pay any tax due.

Employers file a 2020 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension.

Tuesday, August 10

Employers report income tax withholding and FICA taxes for second quarter 2021 (Form 941), if you deposited all associated taxes that were due in full and on time.

Wednesday, September 15

Individuals pay the third installment of 2021 estimated taxes, if not paying income tax through withholding (Form 1040-ES).

If a calendar-year corporation, pay the third installment of 2021 estimated income taxes.

If a calendar-year S corporation or partnership that filed an automatic extension:

- File a 2020 income tax return (Form 1120S, Form 1065 or Form 1065-B) and pay any tax, interest and penalties due.

- Make contributions for 2020 to certain employer-sponsored retirement plans.

RUDLER, PSC CPAs and Business Advisors

This week's Rudler Review is presented by Jenna Polston, Staff Accountant and Mark Benson, CPA, CVA.

If you would like to discuss your particular situation, contact Jenna or Mark at 859-331-1717.

As part of Rudler, PSC's commitment to true proactive client partnerships, we have encouraged our professionals to specialize in their areas of interest, providing clients with specialized knowledge and strategic relationships. Be sure to receive future Rudler Reviews for advice from our experts, sign up today !