The U.S. Department of Health and Human Services, through the Health Resources and Services Administration (HRSA) recently revised reporting requirements for recipients of Provider Relief Fund (PRF) payments.

Period 1 Due September 30, 2021.

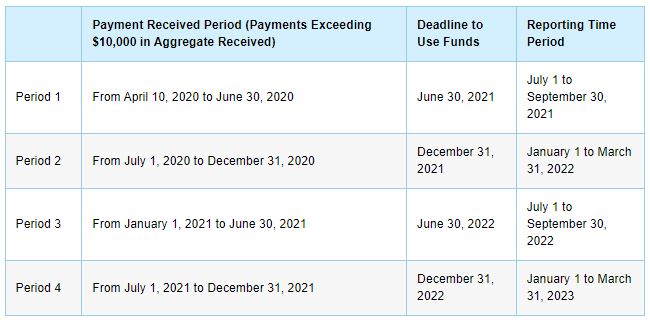

The revision includes expanding the amount of time providers will have to report information, aims to reduce burdens on smaller providers, and extends key deadlines for expending PRF payments for recipients who received payments after June 30, 2020. The revised reporting requirements will be applicable to providers who received one or more payments exceeding, in the aggregate, $10,000 during a single Payment Received Period from the PRF General Distributions, Targeted Distributions, and/or Skilled Nursing Facility and Nursing Home Infection Control Distributions. The revised reporting requirements can be found here - PDF.

Key Updates:

- The period of availability of funds is based on the date the payment is received (rather than requiring all payments be used by June 30, 2021, regardless of when they were received).

- Recipients are required to report for each Payment Received Period in which they received one or more payments exceeding, in the aggregate, $10,000 (rather than $10,000 cumulatively across all PRF payments).

- Recipients will have a 90-day period to complete reporting (rather than a 30-day reporting period).

- The reporting requirements are now applicable to recipients of the Skilled Nursing Facility and Nursing Home Infection Control Distribution in addition to General and other Targeted Distributions.

- The PRF Reporting Portal will open for providers to start submitting information on July 1, 2021.

Summary of Reporting Requirements:

These reporting requirements do not apply to the Rural Health Clinic COVID-19 Testing Program, the HRSA COVID-19 Uninsured Program and the HRSA COVID-19 Coverage Assistance Fund.

HRSA encourages providers to establish their PRF Reporting Portal accounts now by registering here. Registration will also allow providers to receive updates closer to the official opening of the portal for their reporting submissions.

If you would like more information, or assistance with the reporting requirement, contact your Rudler, PSC advisor at 859-331-1717.

RUDLER, PSC CPAs and Business Advisors

This e-Tip is presented by John Wood, CPA, CVA.

If you would like to discuss your particular situation, contact John at 859-331-1717.

As part of Rudler PSC’s commitment to true proactive client partnerships, we have encouraged our professionals to specialize in their areas of interest, providing clients with specialized knowledge and strategic relationships. Be sure to receive future Rudler articles for advice from our experts, sign up today !